Flexible Spending Account Rollover 2025. For a complete listing of irs tax inflation adjustments for tax year 2025, visit irs.gov. What is a flexible spending account, or fsa?

Flexible spending account 2025 limits. If you had a flexible spending account (fsa) prior to 2025, you’ve probably heard the phrase “use it or lose it,” meaning that any unused funds you had.

Tax Benefits of Flexible Spending Accounts, Get the answers to all your fsa questions. For plans that allow a.

A Quick Guide To Flexible Spending Accounts The Thought Card, For a complete listing of irs tax inflation adjustments for tax year 2025, visit irs.gov. In 2025 contributions are capped at $3,200, up from $3,050 in 2025.

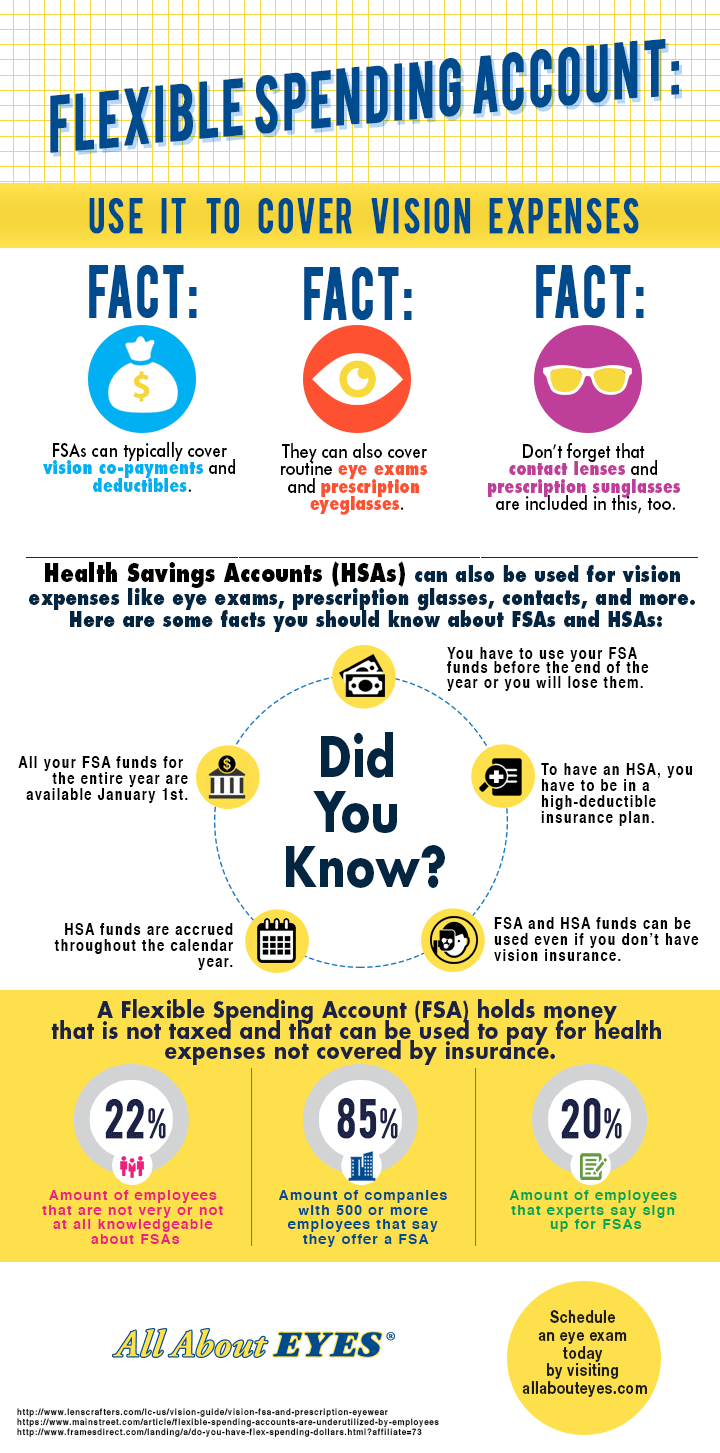

FSA (Flexible Spending Account) Use it or Lose it Val Vista Vision, The maximum amount you can contribute to an fsa in 2025 is $3,050 for. The city of new york offers its employees a flexible spending accounts (fsa) program, which is allowable under internal revenue code (irc) section 125.

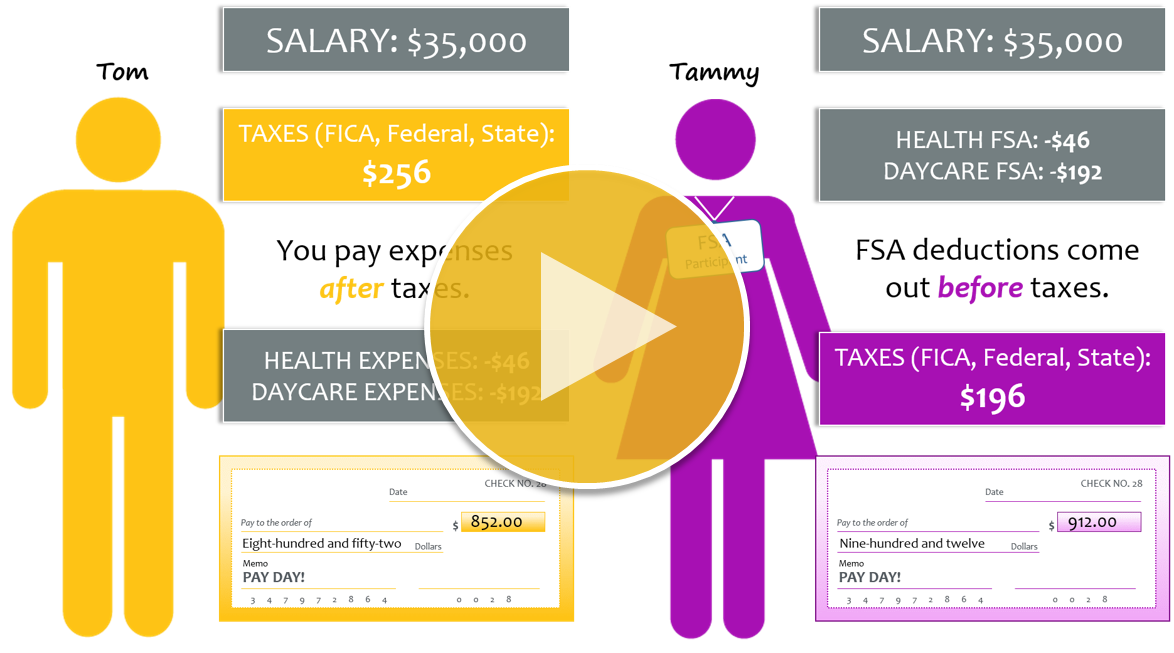

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses. Here, a primer on how fsas work.

FSAs (Flexible Spending Accounts) What Are They and What Are Their, Last updated 9 january 2025. A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses.

Your Flexible Spending Account Use it to Cover Vision Expenses All, For a complete listing of irs tax inflation adjustments for tax year 2025, visit irs.gov. This special senior citizen care fd, which was established in.

Flexible Spending Account The Workplace Benefit You Need to Check Out, The maximum rollover for plan years ending in 2025 was $610. The most money in 2025 that you can stash inside of a dependent care fsa is $5,000, or $2,500 if married and filing separately.

How a Flexible Spending Account Works — Brand 28, What is a flexible spending account, or fsa? Flexible spending account 2025 limits.

FSA Rollover Extensions & More Optional Relief BASIC, The most money in 2025 that you can stash inside of a dependent care fsa is $5,000, or $2,500 if married and filing separately. The maximum rollover for plan years ending in 2025 was $610.

Employee Benefits EES, Getty images) by katelyn washington. For a complete listing of irs tax inflation adjustments for tax year 2025, visit irs.gov.