What Is The Federal Withholding Tax Rate For 2025. The percentage method means that if your bonus is less than $1 million, your employer automatically withholds a flat 22% from the bonus for tax. Marginal federal income tax rate.

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

South Carolina Tax Brackets 2025 Eyde Hyacinthe, The percentage method means that if your bonus is less than $1 million, your employer automatically withholds a flat 22% from the bonus for tax. Effective federal income tax rate.

Texas Withholding Tables Federal Withholding Tables 2025, Houston — a local tax preparer has been. The percentage method means that if your bonus is less than $1 million, your employer automatically withholds a flat 22% from the bonus for tax.

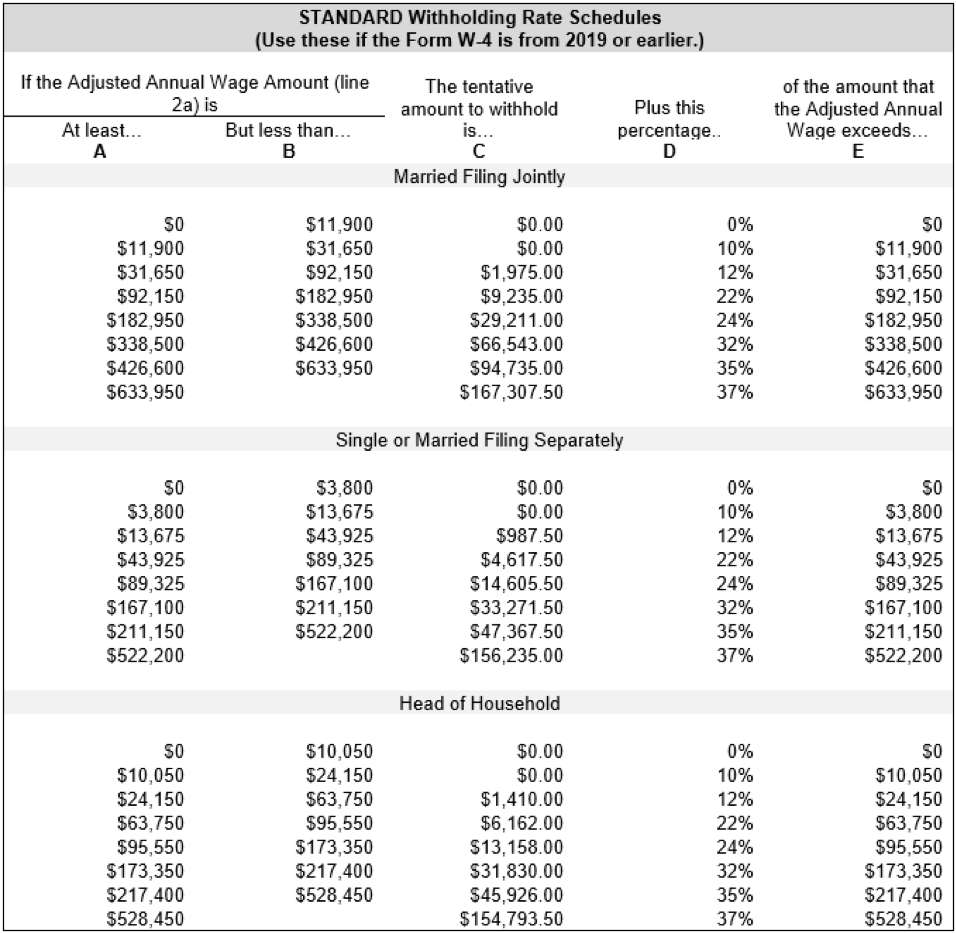

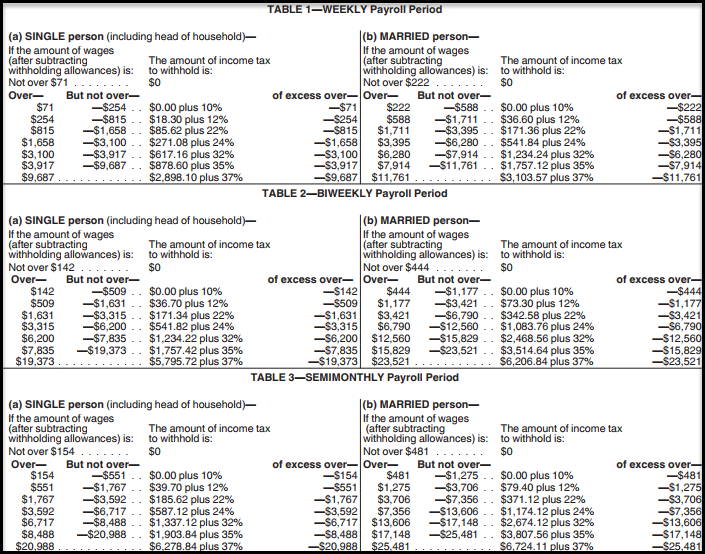

Withholding Tax Rates 2025 Federal Withholding Tables 2025, See current federal tax brackets and rates based on your income and filing status. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Us Federal Tax Tables Federal Withholding Tables 2025, Enter your financial details to calculate your taxes. When using the percentage method, employers withhold 22% for taxes on the first $1m and an additional 37% on any portion of the bonus over $1m.

Federal Tax Withholding Calculator Tax Withholding Estimator, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). The us has a progressive tax system at the federal level with 7 tax brackets.

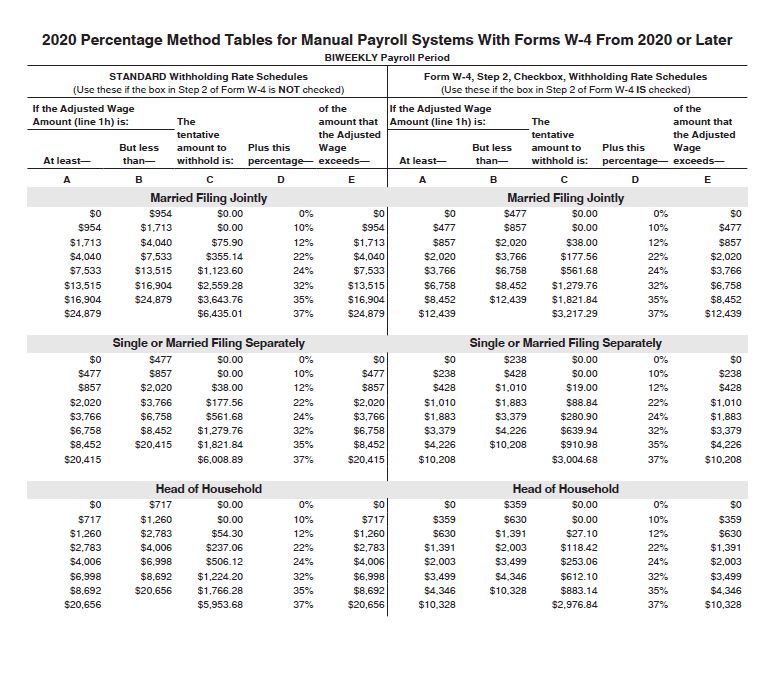

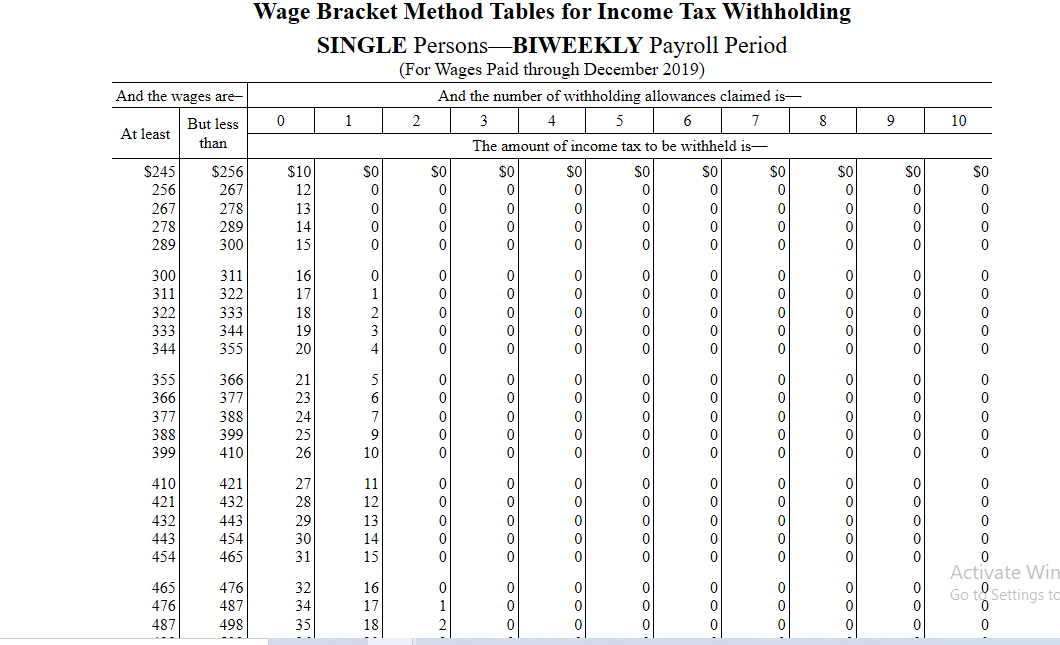

Federal Payroll Tax Tables Bi Weekly Review Home Decor, The us has a progressive tax system at the federal level with 7 tax brackets. The 12% rate starts at $11,001.

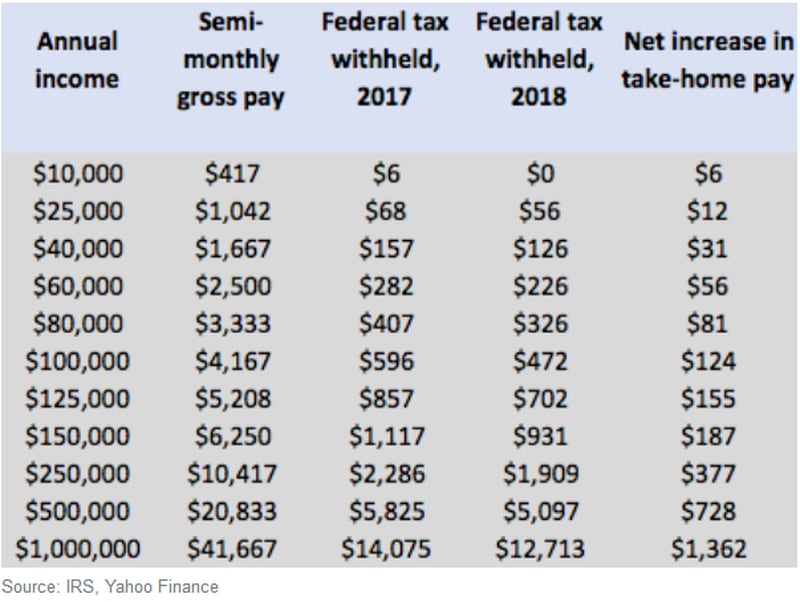

Here's why there's more money in your paycheck, Change of status resulting in withholding less than your tax liability. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Federal Withholding Tax Table Federal Withholding Tables 2025, You pay tax as a percentage of your income in layers called tax brackets. Enter your financial details to calculate your taxes.

Nys Withholding Tax Forms 2025, For taxes due in 2025, americans will see the same seven tax brackets for most ordinary income that they’ve had in previous seasons: Gather documentation (paystubs, previous tax return, invoices, etc.) 2.

Louisiana Weekly Tax Withholding Table 2025 Federal, Taxable income and filing status determine which federal tax rates apply to. The adjustment for determining the amount of income tax withholding for nonresident alien employees doesn't apply to a supplemental wage payment (see section 7) if the 37%.